Definition: Net present value, NPV, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows of a project or potential investment. In other words, it’s used to evaluate the amount of money that an investment will generate compared with the cost adjusted for the time value of money.

This is an important concept because it demonstrates the money isn’t free and one dollar today is always worth more than one dollar tomorrow. The reason for this is simple: interest and opportunity costs. It costs money to borrow money. Thus, the interest rate devaluates future cash. Opportunities costs are not tangible expenses, but they do affect how money is invested.

Most sophisticated investors and company management use a present value analysis or discounted cash flow metric of some kind when they are making investment decisions. This makes sense because they want to see the actual outcome of their choices when interest expense and other time factors are taken into account.

Let’s see how to calculate NPV.

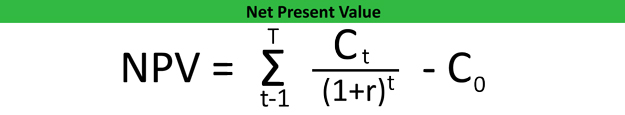

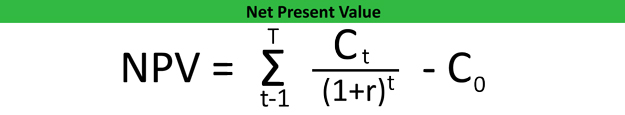

The NPV formula is somewhat complicated because it adds up all of the future cash flows from an investment, discounts them by the discount rate, and subtracts the initial investment.

Here’s what each symbol means:

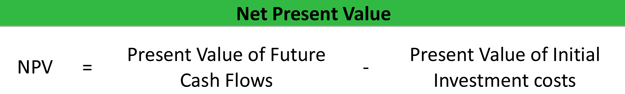

Confused yet? Still wondering what is NPV? Let’s look at a non-mathematical equation, so we can actually understand what is going on.

As you can see, the net present value formula is calculated by subtracting the PV of the initial investment from the PV of the money that the investment will make in the future. This discounts the future dollars that will be generated over the course of the investment’s life with the current dollars that it costs to purchase the investment, so investors can compare the potential return from the investment with its initial cost.

As I mentioned earlier, this is an investment calculation that is used by all types of investors, not just traditional Wall Street investors. Company management compute the net present value of potential projects, expansions, or new equipment to evaluate what option will perform the best and decide what path the company should take in the future.

Take a construction company for example. Management is looking to expand into larger jobs but doesn’t have the equipment to do so. In this case, management would use a NPV calculator to evaluate whether purchasing a new piece of equipment is a good investment by comparing the amount of cash inflows the new piece of machinery would generate and the initial cost of the equipment.

Management can tell instantly whether a project or piece of equipment is worth pursuing by the fact that the NPV calculation is positive or negative. A positive number means the future cash flows of the project are greater than the initial cost. In other words, the company will make money on the investment. If the number is negative, however, the company will spend more money purchasing the equipment than the equipment will generate over its useful life.

Obviously, the greater the positive number, the more return the company will receive. Thus, a net present value calculator can not only be used to judge a good investment from a poor one, it can also be used to compare two good investments to see which one is better. All else equal, the equipment or project with the highest value is the best investment.

Let’s take a look at an example.

Bob’s Construction Company builds small commercial buildings, but Bob wants to expand his operations into larger buildings. In order to do so, he needs to purchase a larger crane that costs $100,000. Bob estimates that he will be able to earn at least $20,000 a year from the crane for the next ten years.

So Bob invests $100,000 and receives a total of $200,000 over the next ten years. Sounds like a good investment, right? Remember the $200,000 is not discounted to adjust for the time value of money.

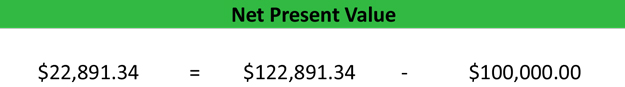

If we assume an interest rate of 10 percent, Bob’s discounted cash flows from the crane will equal $122,891.34. Here’s how to calculate the net present value for Bob’s investment.

As you can see, when we consider the time value of money, Bob doesn’t actually make $100,000 ($200,000 – $100,000). He only makes $22,891.34. This is still a good investment because it generates positive cash flows, but Bob should compare this investment with other options to see if he can invest in something with a higher net PV.

Although this is a great tool to use when making investment decisions, it’s not always accurate. Since the equation depends on so many estimates and assumptions, it is difficult to be completely accurate. Going back to our example, Bob has no idea that the interest rate will stay at 10 percent for the next 10 years. He also doesn’t know for sure that he will be able to generate $20,000 of additional revenue from this piece of equipment year over year. These are just estimates. The only thing he knows for sure is the price he has to pay for the machine today.

That’s why this measurement is a good indicator and not necessarily a tried and true evaluator.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.